Download a PDF copy of this week’s economic commentary here.

Markets

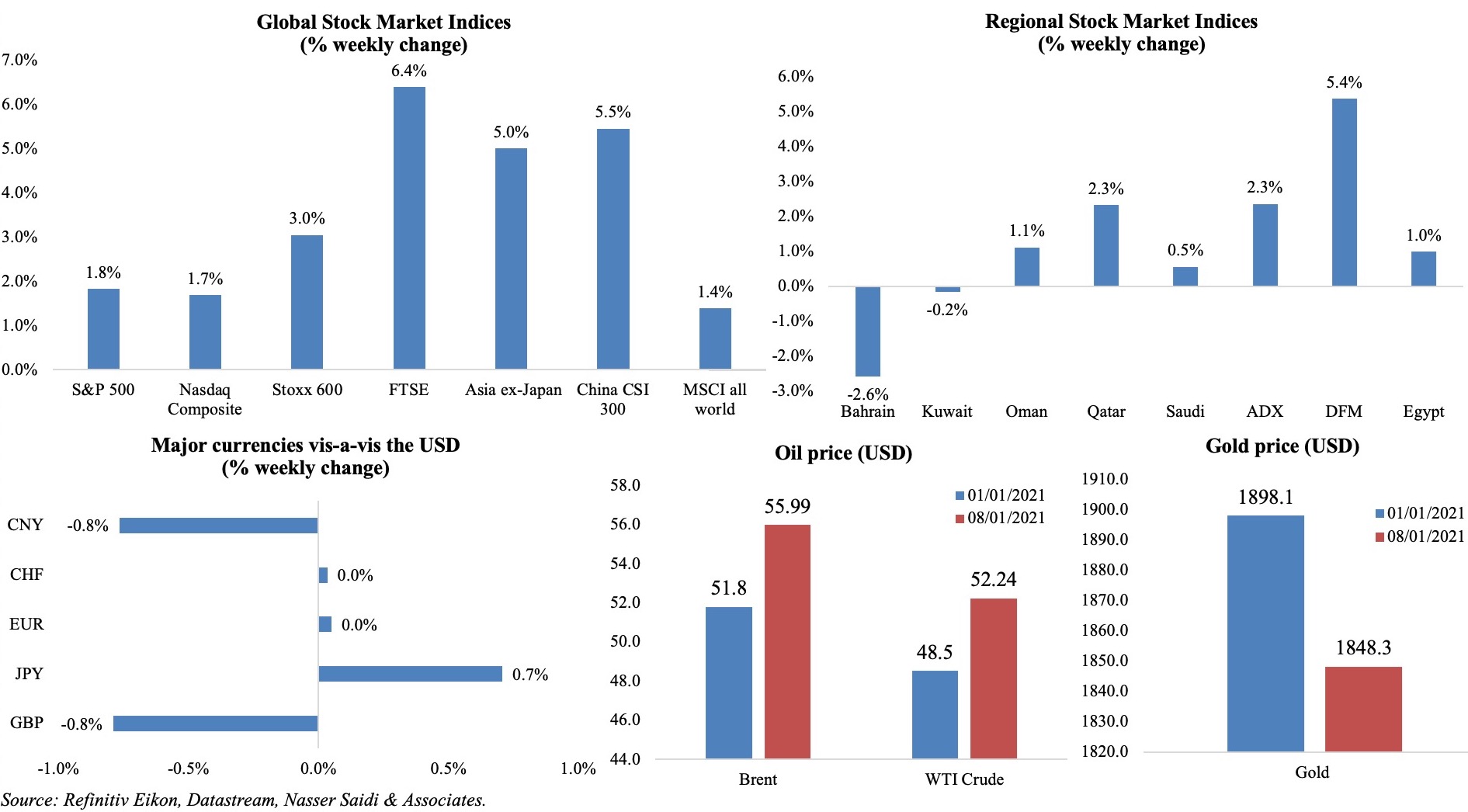

Global equities continue to push new records (US stocks, Japan’s Nikkei) as stimulus measures and vaccination drives trumped political mayhems; MSCI all-world also inched up by 1.4%. 10-year U.S. Treasuries yields touched the highest levels since March. Oil prices inched closer to 11-month highs last week, closing 8% higher last week, given Saudi Arabia’s pledge for deeper, voluntary cuts in Feb-Mar. The rise in oil prices supported markets in the Middle East while Qatar’s exchange saw an uptick given the breakthrough in its diplomatic rift with Gulf nations. The dollar was at a near 3-year low last week vis-à-vis a basket of currencies while gold price ended the week 2.6% lower.

Weekly % changes for last week (7-8 Jan) from 31 Dec (regional) and 1 Jan (international).

Global Developments

US/Americas:

- Democrats won both run-off elections in Georgia, giving them control of both the US Senate (after the Presidential inauguration) and of congress. This will be the first time since 2009 that the Senate, the House of Representatives and the White House are in their control, empowering the Biden administration and its agenda.

- Non-farm payrolls in the US fell by 140k in Dec (Nov: +336k), ending 7 months of jobs growth: women accounted for all the job losses, losing 156k jobs, while men gained 16k. Around 372k jobs were lost in food services and drinking places, offsetting gains in other area Average hourly earnings grew by 5.1% yoy (Nov: 4.4%). Unemployment rate remained unchanged at 6.7%. Earlier in the week, ADP reported that the private sector employment decreased by 123k in Dec (+304k in Nov) – the first decline since Apr 2020 – with losses concentrated in retail, leisure and hospitality.

- Factory orders in the US grew by 1% mom in Nov, after an upwardly revised reading of 1.3% in Oct. Orders for non-defense capital goods excluding aircraft, a proxy for business spending plans, inched up by 0.5% in Nov.

- The Markit manufacturing PMI increased to 57.1 in Dec (Nov: 56.7) – the highest since Sep 2014. Meanwhile, the ISM manufacturing PMI increased for the 7th straight month to 60.7 in Dec (Nov: 57.5), thanks to improvements in new orders (67.9 vs 57.5), production (64.8 vs 60.8) and employment (51.5 vs 48.4).

- Initial jobless claims unexpectedly declined for the third week to 787k in the week ended Jan 2 from an upwardly revised 790k the prior week, with the 4-week average slowing to 818.75k. Continuing claims slowed to 5.072mn in the week ended Dec 26 from 5.198mn the week before.

Europe:

- Economic Sentiment Index in the euro area increased to 90.4 in Dec (Nov: 87.7), driven by higher confidence among consumers (+3.7) and in the industrial sector (+2.9).

- German factory orders unexpectedly grew by 2.3% mom and 6.3% yoy in Nov (Oct: 3.3% mom and 2.3% yoy); industrial orders are now some 4% above their pre-crisis level. Domestic orders went up by 6% and foreign orders by 2.9% – those from the euro area rising 6.1% and from other countries 0.9%. Separately, industrial production grew by 0.9% mom in Nov (Oct: 3.4%), with manufacturing (+1.6%) and construction (+1.4%) offsetting a drop in energy production (-3.9%).

- German exports grew by 2.2% mom (Oct: 0.9%) and imports by 4.7% mom in Nov (Oct: 0.4%), narrowing the trade surplus to EUR 16.4bn. Exports were supported by a double-digit annual exports growth to China as well as UK companies buying spree ahead of the Brexit transition.

- Retail sales in Germany grew stronger than expected in Nov, rising by 1.9% mom and 5.6% yoy (Oct: 2.6% mom and 8.6% yoy), thanks to strong growth in online sales (+31.8%) and spending on home improvements (+15.4%) while clothing sales fell 20%.

- In the eurozone, retail sales fell by 2.9% yoy and 6.1% mom in Nov (Oct: 4.2% yoy and 1.4% mom) – the biggest decline since the first lockdown in Apr. The drop was largely due to a 10.6% fall in demand for automotive fuels and an 8.9% decline for non-food products.

- Inflation in Germany declined by 0.3% yoy in Dec (Nov: -0.3%) while the harmonised index was also unchanged at -0.7% yoy. Inflation in the eurozone declined by 0.3% yoy in Dec, holding for the 4th consecutive month, given weak food prices and a dip in energy prices. Core CPI remained at a record low of 0.2%.

- German Markit manufacturing PMI increased to 58.3 in Dec, the highest since Feb 2018, from Nov’s 57.8. A sharp drop in the supplier delivery times sub-component supported the rise in headline PMI while consumer goods were the weakest-performing category.

- In the eurozone, PMI increased to 55.2 (Nov: 53.8) thanks to stronger roses in output and new orders; growth was led by Germany and the Netherlands, both also reporting the sharpest increases in export sales.

- UK manufacturing PMI increased to a 3-year high, moving up to 57.5 in Dec (Nov: 55.6) though job cuts continued for the 11th straight month.

- Services PMI in Germany touched to 47 in Dec, up from Nov’s 46, but lower than the 50-threshold, as lockdowns and travel restrictions took effect. Composite PMI ticked up down to 52 from a 5-month low of 51.7. In the Eurozone, services PMI clocked in at 46.4 in Dec from Nov’s 46.4 but was lower than the preliminary reading of 47.3, while composite PMI increased to 49.1 (higher than Nov’s 45.3 but lower than prelim 49.8 reading).

- The number of jobseekers in Germany fell by 37k yoy in Dec, boosted by state-backed part-time work scheme, while the unemployment rate remained unchanged at 6.1%. In the wider eurozone unemployment fell slightly: jobless rate dropped to 8.3% from 8.4% in Oct.

- The UK announced GBP 6bn (USD 6.2bn) in new lockdown grants, with retail, hospitality and leisure companies getting one-off grants worth up to GBP 9k, in addition to an extended furlough scheme.

Asia Pacific:

- China Caixin manufacturing PMI remained expansionary in Dec, though easing to 53 from Nov’s 54.9 reading. New orders increased, albeit slowly, given weaker new export sales and a modest increase in demand from abroad. Caixin services PMI slipped to 56.3 in Dec (Nov: 57.8): new order growth and export sales eased, while employment rose for the 5th straight month.

- Foreign exchange reserves in China grew to USD 3.217trn in Dec (Nov: USD 3.178trn) – a new high since May 2016.

- Japan PMI improved to the no-change threshold of 50 in Dec (Nov: 49.7), the highest reading since Apr 2019. Employment levels also increased for the first time since Feb 2020.

- Overall household spending in Japan unexpectedly grew by 1.1% yoy in Nov (Oct: 1.9%), rising for a 2nd straight month largely due to spending on utilities as well as vegetables and meat. In mom terms, however, spending was down by 1.8%.

- India’s PMI edged up to 56.4 in Dec (Nov: 56.3), on stronger demand and expansion in production alongside international demand. However, employment continued to drop for the 9th

- Singapore grew by 2.1% qoq in Q4 (Q3: +9.5%) while in yoy terms, GDP shrank by 3.8% (Q3: -5.6%). Overall, Singapore’s GDP declined by 5.8% in 2020 – the first annual contraction since 2001.

- Retail sales in Singapore fell by 1.9% yoy in Nov, improving from the 8.5% drop in Oct; in mom terms, it grew by 7.3% mom (Oct: 0.2%).

Bottom line: It was PMI week across the globe – global manufacturing PMI was at a 33-month high, with signs of recovery as well as a rise in export orders amid supply chains pressures. Germany’s latest economic data dump showed resilience even in the face of lockdown restrictions, while in the UK the fast-spreading pandemic and response is overshadowing the new stimulus package. Meanwhile, as vaccine distribution picks up pace, the World Bank forecasts global growth at 4% this year should vaccinations be distributed widely and effectively. The IIF revealed that capital flows to emerging markets fell by 13% yoy to USD 313bn in 2020, though Q4 was the strongest quarter for EM securities as asset classes recovered. Lastly, mainstream investors are joining the Bitcoin bandwagon, leading to a surge in prices (see media review link).

Regional Developments

- The Al-Ula agreement was signed at the GCC Summit last week, ending the Qatar blockade (which was imposed in 2017): this improves and will support political stability (a “united GCC” front) and is likely to restore UAE and Saudi businesses direct trade and investment links. Ahead of the Summit, Saudi Arabia and Qatar had reopened land, air and sea borders. Greater GCC regional stability, implies lower perceived sovereign risk, including credit risk which –other things equal- will lead to an improvement in sovereign credit ratings, lower spreads and CDS rates and encourage foreign portfolio inflows as well as FDI.

- The World Bank expects MENA to grow at a modest 2.1% yoy in 2021 – following output losses of around 5% in 2020 – with recovery conditioned on containment of the pandemic (including vaccine rollout), as well as stable oil prices and “no further escalation” of political tensions. Oil exporters are estimated to growth by 1.8% this year, and oil importers by 3.2%.

- Bahrain’s real GDP grew by 1.4% qoq in Q3 2020, thanks to a 1.7% growth in the oil sector amidst a 1.3% increase in the non-oil sector; hotels and restaurants posted the fastest growth (+71.1% qoq). In yoy terms, GDP fell by 6.9% in Q3.

- Egypt’s PMI fell to 48.2 in Dec (Nov: 50.9), with the recent Covid19 surge resulting in subdued demand as well as fears of renewed lockdown measures; inventories rose at the strongest rate since June 2012 while employment cuts were at the strongest in 4 months.

- The IMF raised its GDP forecast for Egypt to 2.8% in the current fiscal year 2020-21, highlighting “strong consumption [that] helped offset weak tourism and investment”.

- The Central Bank of Egypt announced an extension of its initiatives to support defaulters, whether individuals or tourism companies, for a further six months till end-Jun 2021. This initiative, which covers individuals with debts of less than EGP 10mn, will remove the defaulter from the banks’ blacklists and all lawsuits would be waived (on the condition that 50% or more of the debt is paid).

- Egypt’s tourism revenues slumped by 70% yoy to USD 4bn in 2020, due to the Covid19 pandemic, from USD 13.03bn in 2019. The country attracted 3.5mn tourists last year, versus 13.1mn in 2019: of this, about 2.4mn persons visited the country in Jan-Feb before the hotels were closed in Mar.

- Egypt’s net international reserves increased by 2.14% mom to USD 40.06bn in Dec.

- Domestic fuel prices were left unchanged in Egypt, following a similar move in Oct 2020.

- Egypt’s Ministry of Petroleum and Mineral Resources disclosed that 62 oil and gas reserves were discovered in the country last year, a 13% uptick compared to 2019.

- Revenues from Egypt’s Suez Canal declined by 3% yoy to USD 5.61bn in 2020. The Authority revealed that transit fees for all ships would remain unchanged this year.

- Egypt, which is the Islamic Development Bank Group (IsDB)’s seventh largest contributing country and owner of the largest number of shares, was the third largest beneficiary of the bank’s total appropriations at USD 12.7bn, disclosed the minister of planning.

- In Iraq, projects have been allocated about 20% of the 2021 budget: of this, the focus will be on stalled and ongoing projects than new ones, according to the financial advisor to the government. He also stated that there are currently about 19k ongoing projects worth a total of IQD 200bn (USD 168.2mn).

- Iraq signed a USD 2bn prepayment deal with a Chinese company for oil exports, reported the state news agency (without naming the company). According to the agreement, the value of shipment will be paid a full year in advance.

- The World Bank forecasts Jordan’s economy to grow by 1.8% and 2% in 2021 and 2022 respectively.

- The volume of combined assets of the Jordanian banking sector touched USD 5bn by end-Q3 2020. Combined capital, reserves and allocations stood at USD 12.3bn at end-Sep while capital adequacy was 17.9% in H1 2020.

- Jordan’s income and sales tax revenues increased by 8% yoy to JOD 4.668bn in 2020; sales tax revenues grew by 7% to JOD 3.53bn while income tax revenues were up by 12%. The department credited its reform strategy implemented last year (including expanding the tax base and fighting tax evasion) for the uptick.

- Real estate volume in Jordan declined by 26% yoy to JOD 3.418bn in 2020: real estate purchases dropped by 9% while apartment sales were down by 14% compared to the year ago.

- Kuwait’s oil minister revealed the discovery of three new oil and gas fields in the country including one next to the giant Burgan field. One has a production capacity of 1,452 barrels per day (bpd) of light oil while another’s stands at 1,819 bpd of light oil and associated gas.

- PMI in Lebanon remained below-50, with the Dec reading at 43.2 (Nov: 42.4) with output and new orders declining at the slowest pace in 5 months while job cuts accelerated. Demand remained depressed and new export orders fell amid a 14th consecutive monthly contraction in inventories.

- Lebanon’s central bank governor stated that the era of the dollar peg was finished, but that the currency would not be floated unless an agreement was finalized with the IMF.

- The World Bank estimates the cost of damage from the Aug blast at the Beirut port at USD 350mn. A new “governance structure based on the landlord port model” was proposed by the Bank, adding that one of the prerequisites to rebuild the port was the establishment of a robust institutional and governance framework for the port sector. Read more: https://www.worldbank.org/en/news/press-release/2021/01/05/reforming-lebanons-port-sector-to-build-back-a-better-port-of-beirut

- Lebanon started a 25-day lockdown last Thursday – its fourth in 10 months – with a daily curfew from 6pm to 5am amid reports that hospitals were running out of beds and pharmacies running low on medicines to treat Covid19 patients.

- Oman will start enforcing VAT by Apr 16th this year; about 94 items (mostly food) have been exempted from the tax. Implementation of this tax is estimated to generate over USD 780mn, according to the ministry of finance.

- Oman’s Muscat Securities Market was converted into a closed joint stock company and put under the ownership of the state-owned Oman Investment Authority last week, according to state media. It will henceforth be called the Muscat Stock Exchange.

- SMEs registered in Oman increased by 13.4% yoy and 1.2% mom to 47802 at end-Nov 2020.

- Vodafone received a license to become the 3rd operator in Oman.

- PMI in Qatar eased to 51.8 in Dec (Nov: 52.5), with Q4 business activity expanding at the strongest pace since Q1 2018. Manufacturing posted the strongest growth for the second consecutive month, while employment increased – especially in the services sector.

- Qatari banks Masraf Al Rayan and Al Khaliji have entered into a merger: with combined assets worth around QAR 172bn (USD 47bn) as of Sep 30, the merger creates one of the largest Sharia-compliant regional banks.

- Saudi Arabia’s non-oil activity picked up for the 4th consecutive month, with PMI climbing to a 13-month high of 57 in Dec (Nov: 54.7). This uptick was supported by an increase in output and new orders, with Dec also witnessing the fastest rise in new business for 12 months.

- As part of the OPEC+ production cuts, Saudi Arabia pledged to make voluntary cuts by an additional 1mn barrels per day (bpd) in Feb and Mar.

- Saudi Arabia’s trade with the GCC nations plunged by 18.7% yoy to SAR 97.89bn (USD 26.1bn) in Jan-Oct 2020. Furthermore, UAE was the largest trade partner, accounting for 64.1% of total trade during the period.

- Money supply (M3) in Saudi Arabia increased by 7.75% in Jan-Nov 2020 to touch an all-time high of SAR 2.139trn. Cash liquidity reached SAR 2.088trn over Q3 2020, surpassing May’s historic level of SAR 2.075trn.

- The Saudi Central Bank has issued its first-ever license to a consumer micro-financing platform Tamam, which offers loans via a mobile app.

- Saudi Arabia’s mining law, which came into effect on Jan 1st, seeks to boost FDI and will “enhance governance of the sector, improve transparency and increase investor confidence”, according to the minister of industry. Mineral resources in the country are estimated to be worth about SAR 5trn (USD 1.3trn), with 20 million ounces of gold reserves below ground.

- Saudi Arabia will lift the temporary travel ban and resume all international flights from Mar 31st this year.

- A recent Ministry of Commerce decision allows Saudi-owned companies to be managed by foreigners – either as managers or as an authorized person, reported Saudi Gazatte.

UAE Focus

- UAE PMI crossed the neutral 50-mark, posting an increase to 51.2 in Dec from the previous month’s 49.5, thanks to a 15-month high uptick in new export orders and an increase in output level. However, employment continued to fall, with the “rate of job shedding” faster.

- Dubai rolled out a 5th stimulus package worth AED 315mn: this included an extension of some incentives till Jun 202, refunds on hotel sales and tourism dirham fees, one-time market fees exemption for establishments that did not benefit from reductions in previous packages and decision to renew licenses without mandatory lease renewal among others. This brings the overall stimulus package in the emirate to AED 7.1bn.

- Bloomberg reported that UAE’s Mashreq Bank was considering moving nearly half its employees to cost-friendlier emerging market locations like India, Egypt and Pakistan, while allowing others to work from home. The report stated that the relocation plan is likely to be completed in three phases by Oct 2021.

- Almost 17.88 million passengers passed through the Dubai Airports last year, according to GDRFA; smart gates, which facilitated contact-free travel, saw 1.7mn users during the year.

- The Dubai Multi Commodities Centre (DMCC) registered 2050 new companies in 2020 – the highest in 5 years. There was a 20% yoy uptick in the number of Chinese companies in the free zone last year: China is a key market for the free zone, with a representative office opened in Shenzhen last Nov.

Media Review

China’s dollar pragmatism

https://www.omfif.org/2020/09/chinas-dollar-pragmatism/

A Fairer Way to Help Developing Economies Decarbonize

https://www.project-syndicate.org/commentary/developing-economies-decarbonization-taxes-financial-aid-by-kenneth-rogoff-2021-01

Is the financial establishment coming round to bitcoin?

https://www.economist.com/finance-and-economics/2021/01/09/is-the-financial-establishment-coming-round-to-bitcoin

Party city Dubai becomes escape hatch as Europe locks down

https://www.ft.com/content/34fc511e-852e-4d20-bd0e-92aad4117f78

Powered by: