Download a PDF copy of this week’s economic commentary here.

Markets

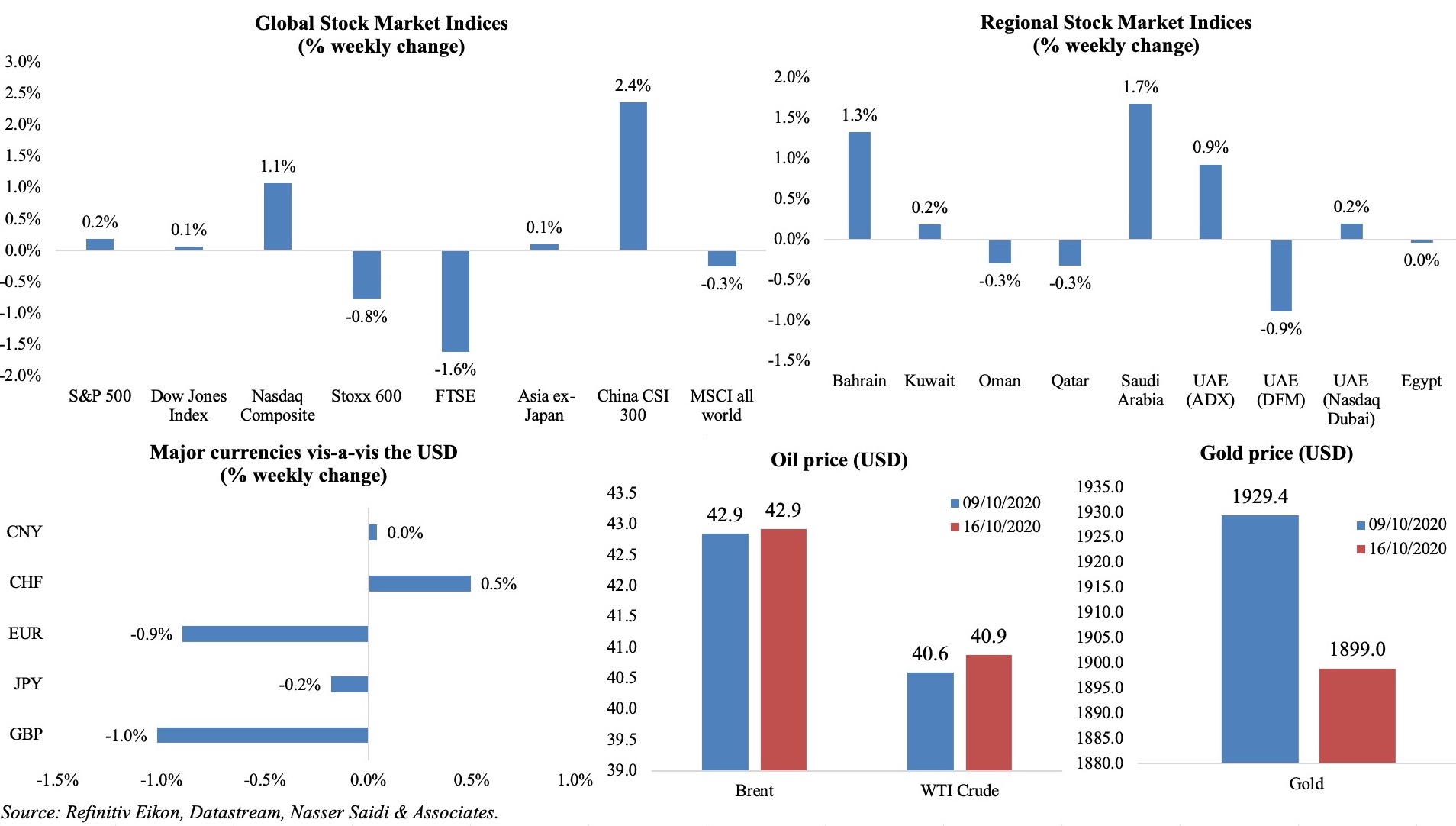

Rising Covid19 cases globally (posting a daily record of 400k on Fri) and tightening of restrictions in Europe spooked investors, amid UK’s PM asking businesses to brace for a no-deal Brexit and fading hopes for stimulus in the US before the elections led most markets across the globe down compared to a week ago. Chinese stocks were up for the week for the 3rd consecutive time. Regional markets were mixed: Saudi Arabia’s bank merger news was received positively while in Dubai, banking stocks pulled the index down. The pound took a battering among currencies, while the safe-haven Swiss Franc posted a weekly gain. Oil prices remained almost flat last week, though new Covid19 cases and restrictions will dampen demand; OPEC+ officials stated that demand is “still looking anaemic” and that it had been recovering slower than expected. Gold price remains around the USD 1900 mark.

Weekly % changes for last week (15-16 Oct) from 8th Oct (regional) and 9th Oct (international).

Global Developments

US/Americas:

- US budget deficit hit a record USD 3.132trn in the fiscal year – more than triple the 2019 shortfall – as spending touched USD 6.55trn (including USD 2trn on Covid19 related spending), outpacing total receipts at USD 3.42trn. The largest deficit prior to this year since World War II was the USD 1.4trn recorded in 2009 at the peak of Global Financial Crisis.

- US inflation inched up by 0.2% mom in Sep, the slowest pace in 4 months, with the largest increase posted by used cars and trucks (+6.7%). Core CPI eased to 0.2% mom (Aug: 0.4%). In yoy terms, inflation ticked up by 1.4%, versus a higher 2.5% in the beginning of 2020. Core PPI rose by 0.4% mom and 1.2% yoy in Sep (Aug: 0.65% yoy).

- US retail sales grew by 1.9% mom in Sep, with clothing and accessories leading the gains (+11%) while electronics was the only sector posting a decline (-1.6%). Excluding autos, retail sales gained by 1.5%.

- US industrial production fell by 0.6% mom in Sep – the first decline since Apr – as manufacturing output fell by 0.3%. Although production has recovered more than half of its Feb to Apr decline, the Sep reading was still 7.1% below its pre-pandemic Feb level.

- Foreign holdings of Treasuries fell for the first time in four months in Aug: holdings of both Japan and China declined to USD 278trn and USD 1.068trn respectively.

- Initial jobless claims increased to 898k in the week ended Oct 10, from an upwardly revised 845k the week before. Continuing claims declined by a million to a seasonally adjusted 018mn in the week ended Oct 3.

Europe:

- Germany ZEW’s economic sentiment plunged to 56.1 in Oct from Sep’s over 20-year high of 77.4, as Covid19 related uncertainty and the risk of no Brexit trade deal weighed on investors’ minds. The current situation reading improved to -59.4 from -66.2 the month before.

- Germany’s harmonized index of consumer prices declined by 0.4% yoy in Sep (Aug: -0.4%). The low rate of inflation reflects the temporary VAT relief implemented by the government.

- Eurozone ZEW economic sentiment dropped 21.6 points to 52.3 in Oct, the lowest since May. The current economic situation index climbed 4.3 points to -76.6.

- Eurozone industrial production inched up by 0.7% mom in Aug, from an upwardly revised reading of 5% in Jul, thanks to increases in durable consumer goods (+6.8%) and intermediate goods (3.1%) while capital goods output dipped (-1.6%). In yoy terms, IP shrank by 7.2%.

- Inflation in Eurozone fell by 0.3% yoy in Sep, following Aug’s drop of 0.2%. The ECB expects inflation to average 1% in 2021 and 1.3% in 2022.

- UK ILO unemployment rate inched up to 4.5% in the three months to Aug, from the 4.3% reading last month. Redundancies rose to 227k between Jun-Aug – their highest level since 2009 – while an estimated 1.5mn were unemployed. Average earnings including bonus was unchanged (Jul: -1%).

- Moody’s downgraded UK credit rating by one notch to Aa3, citing weakening economy, Brexit woes and coronavirus shocks.

Asia Pacific:

- China witnessed a sharp increase in trade in Sep: exports grew by 9.9% yoy – the fastest pace this year – and imports by 13.2%, thereby narrowing the trade surplus to USD 257.68bn in Sep (Aug: USD 416.6bn). Imports of iron ore, semi-conductors and agricultural products picked up, indicating an acceleration of domestic recovery.

- China money supply grew by 10.9% yoy in Sep (Aug: 10.4%), slowing from the 11.1% yoy pace in Jun, but higher than the 8.4% from a year ago. New loans issued increased to CNY 1900bn in Sep, up 48.4% from Aug’s CNY 1280bn, pushing total lending in Jan-Sep to CNY 16.26trn. Total social financing, a broad measure of credit and liquidity, picked up by 5% yoy (Q2: 12.8%) to CNY 3.48trn. FDI into China accelerated by 25.1% yoy to CNY 99.03bn (USD 14.25bn); year-to-date FDI inflows grew by 5.2%.

- China’s inflation slowed to 1.7% yoy in Sep (Aug: 2.4%), the weakest pace since Feb 2019, while producer price index fell for the 8th consecutive month, down 2.1% in Sep (Aug: -2%).

- Japan machinery orders edged up by 0.2% mom, as business spending stabilized, though it was down by 15.2% in annual terms. Separately, industrial production dropped by 13.8% yoy in Aug (Jul: -13.3%).

- India industrial output contracted for the 6th straight month, by 8% yoy in Aug, as manufacturing output declined by 8.6%. Year-to-date, industrial production is down by 25%.

- India WPI increased by 1.32% yoy in Aug from Jul’s 0.16% and following 4 previous months of negative readings. Food inflation stood at 8.17% in Sep versus 3.84% in Aug.

- Singapore’s preliminary GDP for Q3 increased by 7.9% qoq, following Q2’s 13.2% drop, supported by construction (+38.7% qoq) and services (+6.8%). Q3 GDP declined by 7% yoy.

Bottom line: According to Reuters, Europe is currently reporting a million new infections about every nine days, resulting in new Covid19 restrictions being imposed across some parts. With a new wave of infections and no definite indication of when a vaccine will be rolled out, the global economy seems poised for a very slow recovery. This was evident in the IMF’s recent World Economic Outlook, which forecasts global growth declining by 4.4% this year, before rebounding by 5.2% next year. There is a distinct divergent pattern as well: advanced nations growth is estimated to drop by 5.8% this year versus the emerging markets’ 3.3%; recovery is also touted at 3.9% and 6% respectively next year. Separately, the World Bank’s chief economist warned that government borrowings during the pandemic and a looming debt crisis could result in a full-blown financial crisis. Though the G20 offered temporary relief to 73 countries last week by extending a suspension of debt-service payments until next Jul, the question remains whether this move is sufficient.

Regional Developments

- Bahrain’s Electricity and Water Authority clarified that electricity and water subsidies for citizens, at their primary residence, will continue. The entity will increase efficiency to achieve a fiscal balance.

- MPs in Bahrain backed a proposal to defer loans interest-free for four months until the year-end. Banks had previously agreed to defer loan instalments, though interest and administrative fees were charged on the same.

- Population in Bahrain touched 1.5mn as of Mar 17th 2020, as per the census report, with citizens accounting for 47.4% of the total.

- Egypt posted a primary surplus of EGP 100mn in Jul-Sep (Q1 of 2020-21): revenues were up by 18.4% while spending increased by 11%. Spending grew thanks to governmental investments (+60% to EGP 40bn), higher spending on health and education as well as on social security programmes.

- Egypt’s external debt surged by 14.9% yoy to USD 115.1bn in 2019, according to World Bank’s International Debt Statistics 2021 report. In Q1 2020 however, external debt registered the first decrease in more than four years – of 1.2% qoq – largely due to the exchange rate.

- Core inflation in Egypt increased to 3.3% yoy in Sep (Aug: 0.8%); headline inflation stood at 3.7% in Sep (Aug: 3.4%).

- The central bank of Egypt disclosed that trade between Egypt and its trading partners declined by 2.2% in Q1 2020 in the wake of the pandemic – the first time since Q3 2009.

- Egypt’s health and population minister disclosed that no full or partial lockdown would be reimposed if a second Covid19 wave emerged. Instead, they would respond to surges in cases within clusters or specific areas.

- The total number of residential units linked to the natural gas grid in Egypt is about 11.3 million, according to the minister of petroleum and mineral resources. He stated that the government is connecting more than 1mn households to the natural gas network every year.

- Egypt launched its debut USD 750mn, five-year Green Bonds on the London Stock Exchange. Proceeds from the issuance will be used to finance projects in transportation and renewable energy.

- Jordan swore in a new 32-member cabinet last week: the foreign and finance ministers were retained from the previous government. Parliamentary elections are due on Nov 10.

- Income and sales tax revenues in Jordan increased by 9% yoy to JOD 3.51bn in Jan-Sep.

- Jordan imposed a 48-hour blanket curfew from Friday 1am until Sunday 1am, allowing only permit holders to move around. The government spokesperson denied that a 30-day lockdown was being planned.

- The President of Jordan Restaurants Association disclosed that the 2-day curfew last weekend resulted in about JOD 40mn in losses for the food and drink industry.

- Given no announcements from the central bank to the contrary, banks in Kuwait are planning to resume deduction of loan installments starting from Oct, reported Al Rai daily. Postponement of loan installments cost about KWD 380mn over the 6-month period till Sep.

- The chairman of the Union of Hotel Owners in Kuwait disclosed that about 60% of hotels are not functional so far, and that 42 hotels in Kuwait were incurring losses of up to KWD 17.8mn per month.

- Lebanon and Israel launched talks to delimit maritime borders on the disputed sea border, mediated by the US: the talks broke up in less than an hour, with a meeting arranged within 2 weeks.

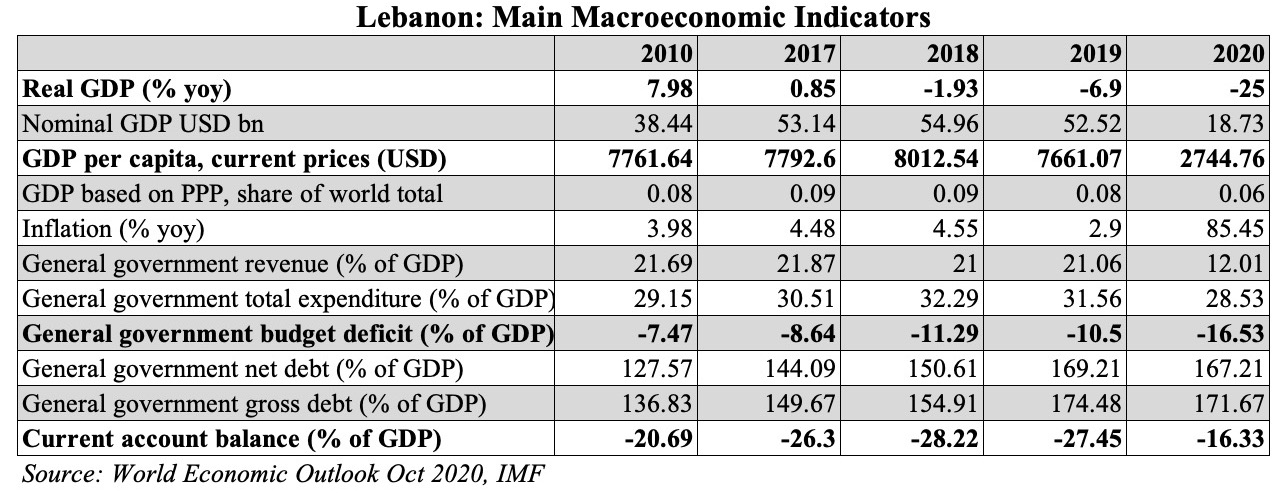

- Some banks in Lebanon have lowered the monthly pound cash withdrawals to between LBP 2-4mn, after a BDL circular that asked lenders to limit their withdrawals based on the size of account they have at the BDL, reported the Daily Star. If widely enforced, the limits will have a strong dampening effect on consumption spending, retail and the overall economy, further deepening the economic depression, with real GDP expected to decline by 25%, with inflation at 85.4% and rising, while the budget deficit increases to 16.5% of GDP.

- Female unemployment in Lebanon surged to 26% as of Sep 2020, from a pre-crisis level of 14.3%, according to the UN. About 132,500 women are out of work, up 63% from the 81,200 reported in 2018-19.

- Oman will introduce 5% VAT on most goods and services from April next year, with exemptions on basic food commodities, healthcare, education, financial services, home rentals and the supply of crude oil, petroleum products and natural gas.

- S&P downgraded Oman for the second time this year, bringing down the rating to B+ with a stable outlook. The rating is 4 levels into the non-investment grade and stands one level lower than the ratings by Moody’s and Fitch.

- Re-exports from Oman stood at OMR 741.2mn as of Jun 2020, from OMR 1.46bn in 2019. Together, the value of goods re-exported from Oman amounted to more than OMR 8bn between 2016 and H1 2020.

- Qatar’s growth declined by 6.1% yoy and 6.4% qoq in Q2 this year, dragged down by the usual suspects transportation and storage (nearly -40% yoy), accommodation and food service activities (-38.7%) and wholesale and retail trade (-30%) while manufacturing fell 11.3%.

- Inflation in Saudi Arabia increased by 5.7% yoy in Sep (Aug: 6.2%): in addition to the VAT hike, food prices surged by 12.6%, while communication, furnishings and transport costs were up by 9.5%, 8.3% and 7.8% respectively.

- Saudi Arabia’s biggest lender National Commercial Bank entered a binding merger agreement with Samba Financial Group to create a combined entity with SAR 837bn (USD 223bn) in assets. Once completed, this merger would be the GCC’s 3rd largest lender by assets following Qatar National Bank and UAE’s First Abu Dhabi Bank. Separately, the SAMA governor stated that the apex bank is considering issuing new bank licenses.

- The Saudi Geological Survey Program will conduct a series of surveys over the next 6 years to unlock mineral reserves estimated to be worth USD 1.3trn. The plan has a budget of SAR 2bn to survey 600k sq kms across the geological formation known as the Arabian Shield.

- Citing recovery in oil demand from China, Saudi Aramco’s CEO stated at an event that “the worst is behind us” for the oil market.

- Saudi Arabia has lowered the minimum wage for Saudi employees to be eligible to receive government support to SAR 3200 from SAR 4000 previously.

- Applications have been invited from Saudi citizens to fill 17k jobs in the retail sector including provision stores and supermarkets by end-2021.

- Bahrain-based International Islamic Financial Market has issued Sukuk Al Ijarah standard documentation templates – including a template prospectus, sale and purchase agreement, ijarah agreement and service agency agreement among others – allowing for significant costs reduction and greater efficiency.

- Google launched a “Grow Stronger with Google” initiative to support 1mn jobseekers and local businesses in the MENA region.

UAE Focus

- The UAE central bank withdrew AED 10.9bn (USD 3bn) of excess liquidity in Aug: certificate of deposits increased to AED 157bn by end of Aug.

- Dubai PMI inched up for the 3rd consecutive month, with the Sep reading rising to 51.5 from 50.9 in Aug. Both output (53.8 in Sep from Aug’s 52.7) and new businesses improved, and the decline in employment slowed to a moderate pace.

- Dubai launched a new residency programme to attract remote working professionals from around the world to relocate to the emirate. The programme, valid for a year and renewable for a similar duration each time, costs USD 287 plus medical insurance with valid UAE coverage and processing fee per person.

- Dubai’s non-oil trade touched AED 551bn (USD 150bn) in H1 this year, with imports accounting for AED 320bn (58.1% of total trade), and exports AED 77bn (14% of total). China was the largest trading partner, with AED 66.4bn worth of trade, followed by India (AED 38.5bn) and the US (AED 31.7bn). Dubai Customs also launched the Cross Border E-commerce Platform to encourage e-commerce companies to set up their businesses in Dubai.

- The value of outward investment from the UAE increased by 11% yoy to USD 155.5bn in 2019, according to the minister of economy. UNCTAD’s latest report showed that FDI outflows increased by USD 1bn to USD 15bn in 2018.

- Abu Dhabi’s economy is expected to rebound by between 6-8% over the next two years, after declining by about 3-4% this year, according to the chairman of the Abu Dhabi Department of Economic Development.

- DFM will launch its new equity futures platform today (Oct 18): the platform will initially introduce futures contracts on single stocks with a tenure of one, two and three months.

Media Review

IMF’s World Economic Outlook, Oct 2020

https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020

https://blogs.imf.org/2020/10/13/a-long-uneven-and-uncertain-ascent/

Financial crisis could emerge from the Covid19 pandemic: World Bank’s chief economist

https://www.bloombergquint.com/global-economics/carmen-reinhart-sees-risk-financial-crisis-emerges-from-pandemic

From peak city to ghost town: the urban centres hit hardest by Covid-19 (long read)

https://www.ft.com/content/d5b45dba-14dc-443b-8a8c-e9e9bbc3fb9a

Is shipping ship-shape? Trade Talks Podcast

https://www.tradetalkspodcast.com/podcast/140-is-shipping-ship-shape/

Don’t Overestimate the COVID-19 Recovery

https://www.project-syndicate.org/commentary/weak-and-uneven-global-covid19-recovery-by-eswar-prasad-2020-10

China Is Now the World’s Largest Economy. We Shouldn’t Be Shocked.

https://nationalinterest.org/feature/china-now-world%E2%80%99s-largest-economy-we-shouldn%E2%80%99t-be-shocked-170719

Powered by: