The article titled “Making it clean: changing the global energy mix” was published in the latest Aspenia Issue, July 2018, and can be downloaded in English and Italian.

The speed of transition to a new global energy mix has accelerated in the past decade. A changing global economic geography with a shift towards fast growing energy-hungry emerging economies (China specifically) as the main growth engines meant a corresponding increase in energy demand that propelled energy prices upwards. Oil prices hit an all-time high of USD 145 in July 2008 before the Global Financial Crisis, and then later in August 2013 to around USD 115. High oil prices provided an incentive for nations (especially emerging ones that ran high oil trade deficits), households and businesses to find substitutes for fossil fuels and lower energy intensity. The EU provided subsidies for renewable energy investments. Concurrently, the OECD countries implemented energy efficiency policies aimed at energy saving, leading to a trend decline in energy used to GDP ratios by some 1%-2% per annum, and breaking the historical link between economic growth and energy demand.

Two additional factors supported the acceleration in energy transition: technological innovation and growing awareness of climate change risks. Innovation in hydraulic fracturing or fracking techniques to extract “tight oil, resulted in the shale revolution and a rapid growth of on-shore oil production in the US. Fracking technology has diffused internationally and its cost has declined: the breakeven oil price for new shale oil wells ranges between USD 46-55, while an oil price between $24 and $38 would cover operating expenses in the US.[1] And the shale oil revolution is spreading internationally: Argentina’s Vaca Muerta (Spanish for Dead Cow), is a shale gas and oil formation the size of Belgium, with technically recoverable oil reserves and shale gas of 27 billion barrels and 802 billion cubic feet respectively, the second largest in the world after China’s 1.12 trillion cubic feet. Technology is changing the economic geography of energy and its global market!

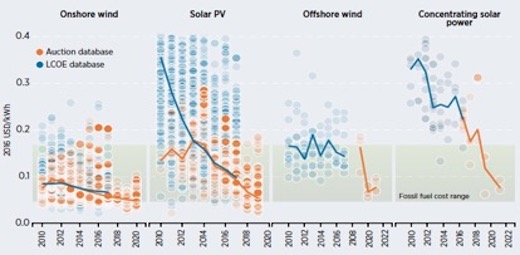

Similarly, technological innovation and investment have dramatically cut the cost of renewable energy. Since 2009, the global benchmark levelised costs of electricity (LCOE) for solar PV has tumbled by 77%, and that for onshore wind by 38%, while lithium-ion battery price index shows a fall from $1,000 per kWh in 2010 to $209 per kWh in 2017[2]. Declining battery costs means falling energy storage costs, which addresses the problem of intermittency of renewable energy. The decline in battery storage costs also means a potential revolution of international trade in renewables-based chemicals and fuels. Government policies to curb climate change alongside technological advances and rapidly falling costs for solar and wind power[3] has meant that renewables are becoming increasingly more competitive, resulting in unsubsidized clean energy world records last year. There is no longer a need to subsidise renewable energy system solutions: global renewable energy prices will be competitive with fossil fuels by 2019 or 2020.

Fig 1: Global levelised cost of electricity and auction price trends for solar PV, CSP, onshore and offshore wind from project and auction data, 2010-2022 (Source: Renewable Power Generation Costs in 2017, IRENA, Jan 2018)

There has also been a massive shift in public opinion and awareness of the implications of global warming. Addressing the risks of climate change has become a key policy priority embodied in the COP21 commitments. All nations (except the US Trump administration) have committed to reduce emissions by at least 20% compared to business-as-usual by 2030. The subsequent COP 22, 23 commitments have all seen unwavering support from countries across the globe (ex-Trump’s US).

A New Oil Normal

The implication of the above trends is that there will be a permanent and persistent secular downward shift in the demand for fossil fuels, putting downward pressure on oil prices. This is the New Oil Normal. For coal producers & coal based utilities and fossil fuel producers and exporters like the GCC countries, the risk is that their vast coal and hydrocarbon reserves will become ‘stranded assets’: they will no longer be able to earn an economic return.

The bottom line is that the increasing prosperity of emerging nations, greater energy efficiency, technological innovation and policy commitments to reduce carbon emissions are resulting in a radical changes of the global energy mix and market. Looking ahead, given their size and demographics China, India and other emerging Asian countries will account for around two-thirds of the growth in energy consumption over the coming decade, to be followed by Africa. Increasingly, these emerging economies are switching to renewable energy sources, given their economic and environmental competitiveness.

A New Energy World is emerging

New investment in clean energy reached USD 333.5bn in 2017, up 3% from the year before but short of 2015’s record-high USD 360.3bn, but higher in real terms. A record 157 gigawatts of renewable power were commissioned in 2017, up from 143GW in 2016, and far out-stripping the 70GW of net fossil fuel generating capacity added last year. Solar alone accounted for 98GW, or 38% of the net new power capacity coming on stream during 2017[4]. A regional comparison shows that the balance of investment has shifted from Europe as largest-investing region to Asia. China set a new record for clean energy investment in 2017, and the UAE was among those investing more than USD 1bn in clean energy along with 10 other emerging nations (from a total 20 countries). And Saudi Arabia announced a massive 200 gigawatts solar power development in the Saudi desert with Softbank that would be world’s biggest solar project and would be about 100 times larger than the next biggest proposed development!

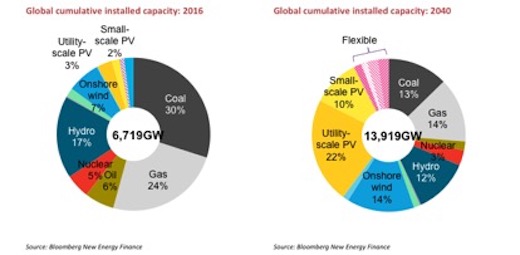

Fig. 2, Global cumulative installed capacity, 2016 and projected, 2040 (Source: Bloomberg New Energy Finance)

Renewable energy sources are set to represent almost three quarters of the USD 10.2trn the world will invest in new power generating technology until 2040, with solar and wind dominating the future of electricity (Fig 2). The world is also increasing investments in clean technologies. A transport and mobility revolution (electric vehicles) will lead to cleaner, healthier cities for increasingly urbanised populations. Not just ‘smart cities’ but also ‘clean cities’.

Twin Revolutions: Renewables and AI & Blockchain

We are witnessing the birth of twin revolutions which will conflate: AI and Blockchain technologies are fusing with new energy. AI is supporting the 4th industrial revolution: think energy and water digitization, smart grids, smart meters, “deep learning”[5], demand management (i.e. manage demand response of different devices that run in parallel), and digital asset management (i.e. where machine learning algorithms collate, compare, analyze, and highlight risks and opportunities across a utilities infrastructure thereby providing an opportunity for power companies) among others. Blockchain technology has the potential to offer a reliable, low-cost way for financial and/or operational transactions to be recorded and validated across a distributed network with no central point of authority, leading to a greater decentralization of energy systems.[6] Applications lie across a vast spectrum: digital tokens to reward users for saving energy, adding smart contracts onto a blockchain, asset and inventory tracking, traceability of water, gas & electricity flows & maintenance, data sharing, fraud detection, electric vehicle charging, and so on. Peer to peer energy trading[7] , the ability of neighbouring homes, ‘prosumers’, to sell solar energy to one another as well as to a shared grid is already being tested.

The challenge to the widespread adoption of blockchain technologies will be to develop an enabling legal and regulatory framework. Country policy frameworks need to be developed to focus on cleantech investments, innovation and commercial conversion, in addition to ’soft’ and ‘hard’ investments to facilitate and integrate the twin revolutions of clean energy and AI and blockchain technologies.

Clean Energy & Economic Development

Energy, water and basic infrastructure are building blocks of economic growth and development. Some 1.1 billion people, of which some 600 million in Sub Saharan Africa, do not have access to electricity. In the absence of electricity they cannot have access to the internet and the digital economy, digital services, let alone participate in the 4th Industrial revolution. The renewable energy revolution offers a new hope to spur and enable economic development of Africa (with its largely untapped hydro and solar potential), India and Asia, using off-grid power systems and decentralisation that do not require expensive, centrally administered national grids. Renewable energy can be local, at village level.

A Renewable Energy Promise?

The IEA has recently warned that the world is headed for irreversible climate change in five years[8]. It is increasingly unlikely that we will be able to keep global warming below 2°C despite COP commitments. Our best hope is to accelerate the global adoption of intelligent renewable energy systems and clean tech for our cities and transport systems, to rapidly change the global energy mix and mitigate the risks of catastrophic climate change.

[1] See Federal Reserve Bank of Dallas https://www.dallasfed.org/-/media/Documents/research/econdata/energycharts.pdf?la=en

[2] See Bloomberg New Energy Finance (BNEF) https://about.bnef.com/blog/tumbling-costs-wind-solar-batteries-squeezing-fossil-fuels/

[3] IRENA estimates that renewable energy will cost less than fossil-fuel generated electricity by as early as 2020.

[4] http://fs-unep-centre.org/sites/default/files/publications/gtr2018v2.pdf

[5] Google cut its electricity bill with AI: the DeepMind-powered AI coordinated datacenter tasks like cooling, and led to a 15% improvement in power-usage efficiency in 2016. Source: https://www.greentechmedia.com/articles/read/google-employs-artificial-intelligence-to-cut-data-center-energy-use#gs.SuwB65o

[6] See Exploring the Impact of Blockchain in the Energy Industry https://nassersaidi.com/2018/02/15/exploring-the-impact-of-blockchain-in-the-energy-industry-30-jan-2018/

[7] The Brooklyn Microgrid paroject: http://brooklynmicrogrid.com

[8] https://www.theguardian.com/environment/2011/nov/09/fossil-fuel-infrastructure-climate-change