To Download as PDF: Harnessing Green Sukuk for Sustainable Development

The recent United Nations Conference on Sustainable Development (Rio+20) in Rio de Janeiro, Brazil, which gathered some 100 heads of state and government, along with thousands of representatives from NGOs, the private sector and civil society, agreed on one thing: The global community must quickly and effectively address the issue of sustainable development; otherwise recurring economic and environmental crises may overwhelm our planet.

Indeed, rising average temperatures and the increasing incidence of extreme weather events herald that our planetary ecological dynamics may be reaching an irreversible tipping point.

Some 220 documented and concrete commitments were registered at the conference in a 53-page outcome document entitled ‘The Future We Want’ and agreed on by member states after negotiations. The document calls for a wide range of actions, including the establishment of sustainable development goals, and details how a green economy can be used as a tool to achieve sustainable development.

The http://cloudofcommitments.com/ website is tracking these commitments, 57% of which are energy related, 18% water, 10% cities while our dying oceans only receive 5% of commitments, reflecting that protecting the commons was only nominally on the agenda.

Avoiding a planetary tipping point as a result of climate change requires that announced commitments be translated into strategies, policies and actions. In turn, policies and actions will require massive financing. The money needed to combat climate change exceeds USD 10 trillion over the next two decades, according to the International Energy Agency, with growing calls for using longer-dated ‘green-themed’ debt instruments for financing.

Investments in clean energy, a key climate change solution, have already begun to grow at an impressive rate. According to Bloomberg New Energy Finance, global investment in clean energy reached USD 211 billion in 2012 and USD 260 billion in 2011. According to the Pew Charitable Trust, investment in clean power assets alone could reach USD 2.3 trillion during the 2010-20 decade.

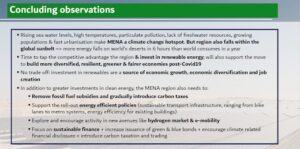

Nowhere are the climate change and sustainability issues more acute than in the Middle East and North Africa (MENA) countries. The MENA region is particularly vulnerable to climate change. We live in some of the most fragile ecologies on earth. We are one of the most vulnerable regions to warming, reduced precipitation and rise in sea levels.

Water supply sources in the Arab world, two-thirds of which originate outside the region, are being stretched to their limits. The level of water scarcity is the highest in the world and is rapidly growing, threatening to lead to confrontation, to ‘water wars’.

A recent report by the Arab Forum for Environment and Development stated that the Arab world will face severe water shortages as early as 2015, as the annual per capita share will be less than 500 cubic meters. This is less than 10% of the world’s average. Yemen is expected to be the first country to run out of water. The same report warned that without fundamental changes in policies and practices, the situation will get worse, with drastic social, political and economic ramifications.

The growing threat of severe economic and social consequences of climate change along with the growing budgetary burdens of fossil fuel subsidies (the MENA countries are one of the highest absolute and per capita fuel subsidy providers) are leading to policy change. MENA countries have high carbon footprints – notably the GCC countries – but also have enormous potential for low-carbon solutions through clean energy.

The region is currently seeing an explosion of clean power projects in planning and implementation, along with significant planned investments in energy efficiency and carbon reduction projects, with a focus on solar energy utilising projects. How will these projects be financed? Given the risks involved and the long gestation horizon of clean energy projects it is efficient to use debt financing.

In particular, I would like to make a case for financing clean energy and clean tech investments in the MENA region through sukuk and Shariah-compliant capital market financing instruments to be dubbed “Green Sukuk”.

High oil and gas prices have generated an extraordinary level of international assets and liquidity in the hydrocarbon exporting countries of the MENA region, with gross foreign assets forecast to reach some USD 2.3 trillion by end-2012. Research also suggests that there is a growing demand in the Middle and Far East for Shariah-compliant or Islamic sukuk, but a shortage of such products.

A major reason is that oil-exporting governments, which would be the main issuers of debt and sukuk, have been running high budget surpluses over the past decade and as a result have not had to resort to debt finance. For related reasons, corporates in the Gulf countries have also been cash rich and therefore not reliant on market financing.

However, the global financial crisis, the contagion effects of the Eurozone’s continuing crisis and retrenchment of EU banks, along with growing financial sophistication of both the public sector and Gulf private businesses, is changing financing strategies.

The GCC countries are keen to lead in innovative finance as they develop financial centers and diversify their economies. Additionally, government and government-related entities responsible for the clean energy build out in the Middle East are becoming regular issuers of bonds and sukuk, given the long gestation and life cycle of energy projects. In this context, a Shariah-compliant “Green Sukuk” would be an ideal investment instrument for the MENA region as it would meet the investment requirements of Shariah-compliant investors from the GCC, Asia and global institutional investors increasingly cognizant of the benefits of environment, CSR and corporate governance compliant investments.

It is estimated by Barclays Capital and Accenture that 25% to 40% of institutional investors’ assets under management are dedicated to fixed-income debt, including asset-backed securities. The sukuk market is well-suited to channel the growing global pool of Shariah-compliant capital to fund clean and renewable energy and climate change projects.

A Green Sukuk market would also extend beyond MENA. Less developed Muslim and non-Muslim countries in Asia and Africa have significant potential for clean/renewable energy for sustainable development along with significant requirements for investment to protect themselves from the impacts of climate change.

In light of the above, the Clean Energy Business Council of the Middle East and North Africa (CEBC), the Climate Bonds Initiative and the Gulf Bond and Sukuk Association have launched a Green Sukuk Working Group (GSWG). The group aims to channel market expertise to develop best practices and promote the issuance of sukuk for climate change solutions investments, such as renewable energy and clean tech projects.

Green Sukuk are Shariah securities and investments that use criteria for climate solutions developed by the International Climate Bond Standards scheme. This scheme is also backed by a group of institutional investors and leading environmental non-government organizations including theCalifornia State Teachers’ Retirement System (CalSTRS); the Natural Resources Defense Council; theCalifornia State Treasurers’ Office; the Investor Group on Climate Change (IGCC); the Carbon Disclosure Project; and the Ceres Investor Network on Climate Risk (INCR).

The scheme also has an industry working group that provides input into the formulation of eligibility criteria, with participation from organizations such as the International Finance Corporation (IFC),Standard & Poor’s, Aviva Investors and KPMG.

With Saudi Arabia planning investment of at least USD 100 billion into clean energy resources over the next decade, and the UAE and many other MENA countries following suit, there are substantial and viable projects in the region that are ideally suited to sukuk investors. The CEBC will help investors more easily identify Shariah-compliant opportunities while assisting in providing the debt capital for clean energy and other climate-friendly projects in the region.

This initiative is an important step toward creating the foundations of a strong future green economy and the basis for effective sustainable development of the MENA region.

Dr. Nasser H. Saidi is the Chief Economist of the Dubai International Financial Center and executive director of the Hawkamah-Institute for Corporate Governance. He is a member of the IMF’s Regional Advisory Group for MENA and Co-Chair of the Organization of Economic Cooperation and Development’s (OECD) MENA Corporate Governance Working Group.

Harnessing Green Sukuk for Sustainable Development in MENA

11 July, 2012

read 5 minutes

Read Next

Test Category 1

“Clean Energy Market in MENA: Finance, Mobility, Hydrogen, Energy Efficiency”, Keynote presentation at the CEBC-Enterprise Ireland event, 5 Oct 2021

Dr. Nasser Saidi, in his capacity as the Chairman of the Clean Energy Business Council,

10 October, 2021

media page

"Climate goals: a priority for business growth", article for DWTC, Mar 2021

The article titled “Climate goals: a priority for business growth” was written for the Dubai

8 March, 2021

Test Category 1

Interview with Energy & Utilities on the impact of Covid19 on renewable energy, 9 Jul 2020

Dr. Nasser Saidi, Chairman of the Clean Energy Business Council speaks to Middle East Energy’s

10 July, 2020