NASDAQ-Dubai listed firms lead in transparency rankings under BASIC methodology developed by The National Investor and in partnership with Hawkamah

In the current environment of global credit freeze and at a time when listed firms in the Gulf have been struggling to attract capital, GCC issuers have surprisingly shown an increasing level of transparency according to the latest GCC transparency rankings.

The Behavioral Assessment Score for Investors and Corporations (BASIC) rankings for 2009, reveal a significant improvement in GCC corporate communication and disclosure, in a very short period of time of less than one year. BASIC is a unique scoring methodology for ranking GCC listed firms on the basis of liquidity, transparency and volatility developed by The National Investor (TNI) in partnership with Hawkamah Institute for Corporate Governance,

Overall, the GCC average BASIC has improved by 8.3 per cent while the corporate communication and disclosure categories have improved by 7.7 percent and 12.6 per cent respectively.

NASDAQ-Dubai companies, which were included for the first time, came in as BASIC leaders compared to regionally listed companies.

Size and age do not matter when it comes to good governance. Arab Insurance Group (Arig) dominated the BASIC ranking for the second year in a row with its market capitalization of just US$ 185 million. Sorouh Real Estate, which has been listed for less than four years, ranked first in Abu Dhabi and third across the GCC.

The second edition of BASIC also shows decreased liquidity as financial assets dry up, and increased volatility during one of the worst stock market collapses.

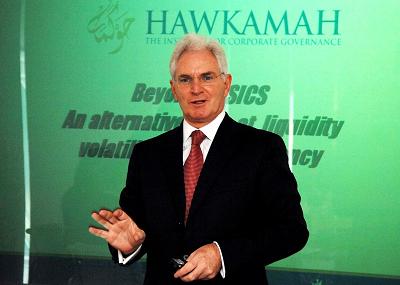

“All crises have an upside too,” stated Dr. Nasser Saidi, Director of Hawkamah. “Shrinkage of the financial pie has resulted in greater competition for the available capital, which in turn, has forced Gulf firms to adopt better corporate governance policies. This is clearly reflected in better transparency and disclosures as is evident from the latest BASIC rankings.

“We believe that BASIC in the GCC is embryonic but promising; the average of our sample of eight international companies is unchanged from last year. During the same time, GCC companies have moved forward steadily,” he said

“Transparency and better disclosure are part of a wider acceptance of good governance that can only help boost the potential for survival, growth and prosperity of any company. This is a positive development for our region as transparency and good corporate governance will add value to the region’s capital markets,” Dr. Saidi added.

To raise awareness, Dr Saidi poned out that a new website has been createdwww.tnihawkamahresearch.org, which is now up and running.

Amer Halawi, Managing Director at The National Investor, said: “GCC listed corporations are bucking the trend of the financial crunch by improving their corporate communication practise and providing more transparency. Some companies have increased their score 2 or 3 times in less than one year.

“Such progress is encouraging and signals a necessary, positive shift in regional attitudes. It is also here to stay. I am very hopeful that we will see further improvement in regional transparency over time.” Halawi added.

In accepting the BASIC award for being the most transparent firm in the GCC, Yassir Albaharna, the CEO of Arig, commented: “We are extremely pleased and proud to be selected as the leader among all companies listed in the GCC in terms of transparency, disclosure and corporate communications for the second year running. This is a wonderful reward for our efforts to be as open and informative as possible – something we regard as our foremost corporate duty vis-à-vis the company’s numerous stakeholders.”

BASIC aims to encourage regional corporations to provide greater liquidity, more transparency and less volatility by holding them accountable and continually and independently benchmarking actual practices against regional and international norms.

The methodology allows to score and benchmark GCC listed companies on the basis of their corporate communication, disclosure and stock-market trading history. This methodology is unique and is the result of a long development and data gathering process.

BASIC is useful to investors who may use it to quickly gauge the liquidity, transparency and volatility of any GCC-listed company. It is useful to issuers who will find preliminary corporate governance guidelines in the methodology and will be able to benchmark themselves against international best practice. BASIC is also useful to regulators who might use the model’s parameters to provide a better trading environment.

Global Financial Crisis has brought on increasing transparency and disclosure among GCC corporates

13 April, 2009

read 3 minutes

Read Next

Media Comments & Quotes

Comments on CSR, Global Post via Xinhua, 19 May 2015

Click here to access the original article, published 19 May 2015; comments highlighted below. Corporate social responsibility

20 May, 2015

MENA Economics

Ethics, Rebuilding Trust in Finance & Some Lessons from Islamic Finance: Speech at EFICA 2014

This keynote address was given at Ethical Finance Innovation Challenges & Awards (EFICA) 2014, organised

30 October, 2014

Media Comments & Quotes

Regulators may be the “new rock stars” but don’t forget the media: The National

[This article by Frank Kane appeared in The National on 18th Feb, 2014. Link to

19 February, 2014