Global Developments

- The US Fed took additional quantitative easing measure (promising to buy $300 billion of US Treasuries, $750bn of mortgage backed securities and $100bn agencies’ debt). For the first time in living memory the US Fed has started to operate on the long end of the yield curve having exhausted all the margins on the short end. The final statement in fact depicts a worsening scenario since the last meeting, asserting that rates will remain near zero for an extended period. The good news is that the Federal Reserve is firing all its weapons at the recession. The bad news is that the recession is severe enough that all weapons are needed. The 10-year Treasury yield fell from just over 2.9% before the announcement to under 2.6% afterwards. Mortgage rates should follow Treasury yields down and spark another refinancing wave. All in all the measures will solve the crisis quickly but represent a useful, albeit not decisive, step in the direction of revitalizing the economy.

- US Industrial production fell more than expected by 1.4% on the month and 11.2% on the year confirming that the sector is still mired in an extremely sharp slump. Capacity utilization is 70.9% marginally lower from a month earlier and approaching the all time low of 1982. A rebound remains a distant prospect.

- The US Conference Board’s leading indicator fell 0.4% in February, after a 0.1% increase in January.

- Euroland employment fell by 0.3% in Q4 not a bad figure if compared with the abysmal data from the US but nevertheless a negative sign that the deterioration might just be lagging.

- ZEW indicator fell sharply to 38 hinting at a deepening recession in Europe. The IMF also raised the alarm over a worsening outlook in Europe.

- The Bank of Japan (Central Bank) voted unanimously (on Wednesday) to hold its overnight rate target unchanged at “around 0.10%”, but lifted its purchases of government bonds to JPY 1.8trn a month.

- Singapore export, a widely observed indicator of global activity fell by almost 24% on the year.

- The IMF is reportedly ready to approve a 20US$ bn bail out plan for Romania one of the large East European countries at risk of defaulting on its debt.

Regional Overview

- The Emir of Kuwait dissolved the Parliament and called for new elections to be held within two months appointing the Crown Prince as the new Prime Minister. Analysts observe that the polls are likely to return a new Parliament with the same composition as the one dissolved. Another consequence is the likely delay on the ratification of the agreement to form a monetary union in 2010. Moody has warned of possible downgrade as a consequence of political turmoil.

- A survey by the Saudi British Bank (Saab) for the first quarter of 2009 showed the level of business confidence in Saudi Arabia had dipped below 90 for the first time. Additionally, Saab said the business confidence could have plunged further had the country not adopted record spending for 2009 to mitigate the effects of the global crisis.

- Car sales in Saudi Arabia have dropped by around 80% in January, sources close to the car industry said.

Market Intelligence on the UAE:

- President His Highness Shaikh Khalifa Bin Zayed Al Nahyan in an interview with Al Roya asserted that the UAE is working well, and that its decision-making process is dealing successfully with the global financial crisis. He dispelled rumors of disagreements saying “we are members in one entity, and parts in one strong, coherent body”.

- The UAE economy will contract further in the coming months, due to the impact of the global financial turmoil, according to Sultan Bin Saeed Al Mansouri, UAE Minister of Economy, as reported by Zawya.

- Standard & Poor’s downgraded the credit ratings of eight Dubai companies on Tuesday, including Emaar Properties, and expressed worries about the health of banks as the economy could shrink between 2 and 4% in real terms this year, as lower oil prices and the global financial crisis take their toll on real estate prices and equities.

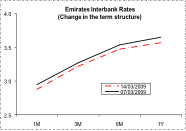

- According to the Governor of the UAE Central Bank, a plan to cut interest rates will soon be introduced by the UAE Central Bank along with a number of other measures to ease the economic slowdown caused by the liquidity shortage.

- UAE banks launched the one-week Emirates Interbank Offered Rate on Monday, to meet demand for short-term liquidity. The rate was set at 1.51875%.

- Around $335 billion of UAE construction projects have been put on hold given the global financial crisis, according to the Middle East Economic Digest. The total value of projects under way in the UAE has fallen to $254 billion, according to the same source.

- A possible merger of the UAE’s largest Islamic mortgage providers, Amlak Finance and Tamweel, is in the final stages, while the liquidation option has been taken off the table, Sultan Bin Saeed Al Mansouri, Minister of Economy, told reporters.

- Bank debts do not form majority of bounced cheques in the UAE, according to the Central Bank Governor. Only 15% are related to bank debts, while 85% relate to landlords and the business sector.

- Moody’s has put HSBC Middle East under review for a possible downgrade, based on a weakening UAE economy and worries over the bank’s parent company.

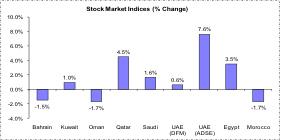

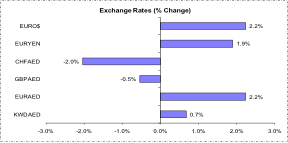

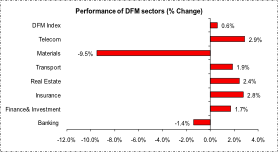

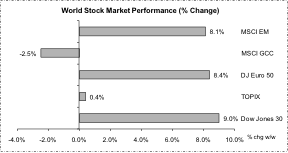

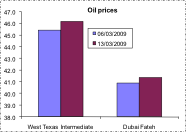

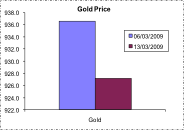

Market Snapshot as of 22/03/2009 at 14:00 (all % figures are weekly changes from 08/02/2009)

Friday proved……. Though improving from last week, oil price rose toward $46 a barrel as bearish forecasts for demand outweighed the potential for production cuts agreement when the OPEC meets today.

Source: Reuters 3000Xtra, DIFC Economics.