Global Developments

- Financial markets have been relatively calm due to the festive period and low volumes. This consolidation together with subdued volatility seems to indicate a willingness to look beyond the most dreadful quarter in decades and focus on the future outlook.

- The most recent economic data releases are still dismal, as they refer to the past two or three months.

- US Consumer confidence was substantially weaker than expected, with a drop to an all-time low of 38.0 from 44.7, driven by a very sharp decline in views of the present situation. The pessimism was highest on the labor market, with consumers viewing jobs as very “hard to get”.

- Purchasing managers’ indices are down again virtually everywhere: U.S. 32.4 versus 36.2 in November; Euro area 33.9 versus 35.6; Japan 30.8 versus 36.7 (the small business survey in Japan fell to 27.8 versus 35.1). Spanish auto sales were down 50%yoy in December.

- The U.K. housing market continues its plunge, with house price deflation accelerating to the 2%-3%mom range through December.

- Korean industrial production fell 10.7%mom sa in November, while exports fell 6%m/m (nsa) in December, a 17.4%oya decline (they had fallen 19%oya in November, however). For Q4, exports were down 18.7%q/q (nsa and not annualized) versus Q3.

- Saudi Arabia will post a budget deficit in 2009 for the first time since 2002. However since 2008 revenues were 144% higher than the original budget estimate, sizeable resources are still available to boost growth. The KSA is set to boost expenditure on infrastructure projects in 2009 a move that will have important spillovers on all other GCC countries.

Market Intelligence on the UAE:

- The Heads of States of GCC countries approved the blueprint for the Gulf Monetary Union and signed the agreement for the Monetary Council. Despite the fact that the move was hailed as a progress towards GMU, in reality it represents a serious setback for the 2010 deadline. The ratification process could take up to one year and the Statute of the Central Bank has not even been discussed. Moreover a decision on the location has been postponed. The summits gave the green light to the railways project feasibility study along with a nod to the $7 billion (Dh25.69 billion) GCC power grid.

- The U.A.E. Federal National Council has approved the federal budget for 2009, the largest in the country’s history. The new budget of AED42.2bn represents a 21% increase from the 2008 budget, but it is still a balanced one. The education and services sector have been allocated the largest proportions of the budget, 23% and 37% respectively.

- The construction sector remains the epicenter of weakness in the UAE. About 50% of property developers have put on hold their plans for lack of financing or doubts about their economic viability.

- According to Nasser bin Hassan Al Shaikh director general Dubai Department of Finance “In 2009-2010, the supply of housing units would be much less than the earlier anticipated. No more than 28,000 units would turn out to have been delivered in 2008, contrary to estimates of 60-70,000 units.

- A senior source at the construction giant Arabtec said some 5,000 workers could be laid off in the coming weeks. Delays in payments are reported across the industry.

- The UAE Central Bank said credit growth in the country would shrink from close to 50% in the first half of this year to less than 10 per cent in 2009.

- Several banks have suspended loans to construction, real estate companies and the hospitality sector, including their employees.

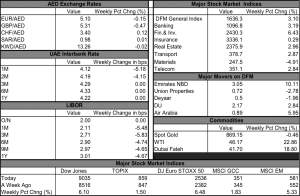

Markets Overview Jan. 5th 2009

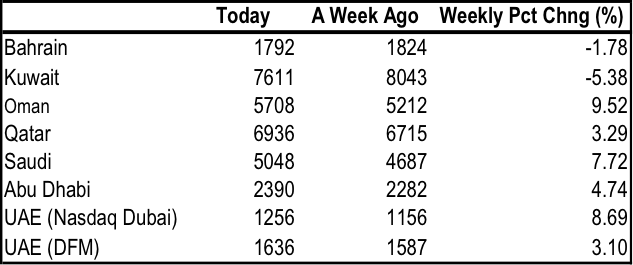

World stock markets continue their consolidation, both in developed and emerging markets. Across the Gulf, stock markets have also rebounded, with the exception of Kuwait and Bahrain. The DFM has displayed a broad based recovery across sectors with the exception of Materials. The Libor rates have normalized, while the UAE Interbank rates still indicate that tensions in the money markets have not completely abated. Exchange rates remain broadly stable and oil is regaining some lost ground in the wake of security concerns after the Israeli aggression on Gaza.

Updated 845am from Reuters 3000Xtra